The Bitcoin (BTC) price has recently surged to new all-time highs above $70,000 amidst volatile trading conditions. Despite a brief reversal back under $67,000, the momentum suggests a strong possibility of a sustained push above $70,000. This bullish sentiment is fueled by robust spot Bitcoin ETF inflows, particularly evident in the strong performance of various ETFs such as BlackRock’s IBIT, Fidelity’s FBTC, and Ark/21 Shares’s ARKB.

Recent market dynamics, including significant outflows from GBTC being offset by substantial inflows into other spot Bitcoin ETFs, indicate a favorable environment for Bitcoin price appreciation. Additionally, macroeconomic factors such as falling DXY and US bond yields following comments from Fed Chair Jerome Powell hinting at potential interest rate cuts further support the bullish outlook for Bitcoin.

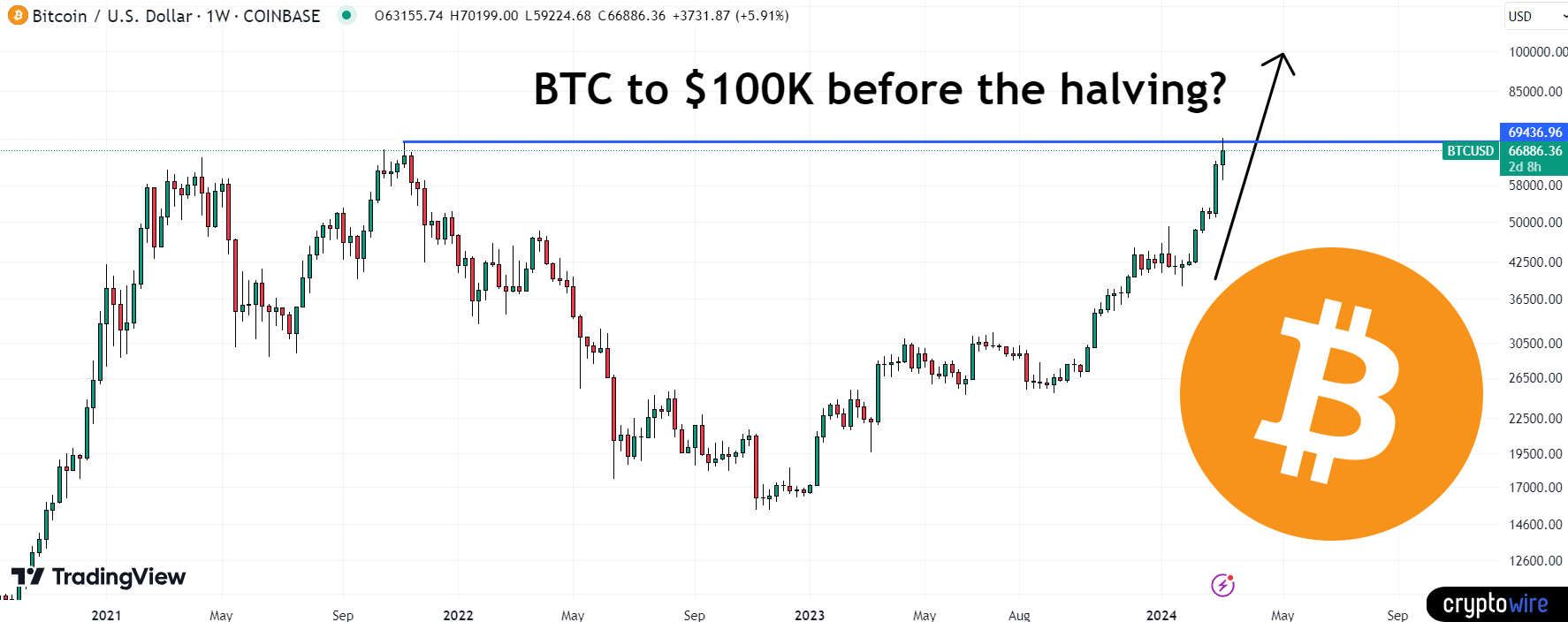

Despite a recent sell-off post new all-time highs, the relatively shallow pullback compared to previous corrections suggests a diminishing appetite for profit-taking. This trend, coupled with positive narratives surrounding Bitcoin, including ETF inflows and the upcoming halving, sets the stage for a potential surge towards the $70,000 mark and beyond.

With the possibility of Bitcoin reaching $100,000 before the April halving not entirely ruled out, the current market sentiment remains optimistic. Traders and investors are closely monitoring key factors that could drive further price appreciation, making the journey towards six-figure Bitcoin prices an exciting prospect in the near future.

Ian is a cryptocurrency enthusiast blending humor with professionalism. With an engineering background and a storyteller's heart, he simplifies the blockchain world with sharp analysis and a touch of wit. At Cryptowire, he brings his unique perspective to make digital financial innovation accessible to all.