📰 Table Of Contents

Riot Platforms, a major Bitcoin miner, faces challenges

Riot Platforms, one of the leading Bitcoin miners, has recently issued a cautionary statement regarding potential profitability challenges in its business operations. Several factors, including global supply chain disruptions, chip shortages, and increasing regulatory scrutiny around climate change, pose significant threats to its operations.

Higher Bitcoin Mining Difficulty Requires Higher Hash Rate

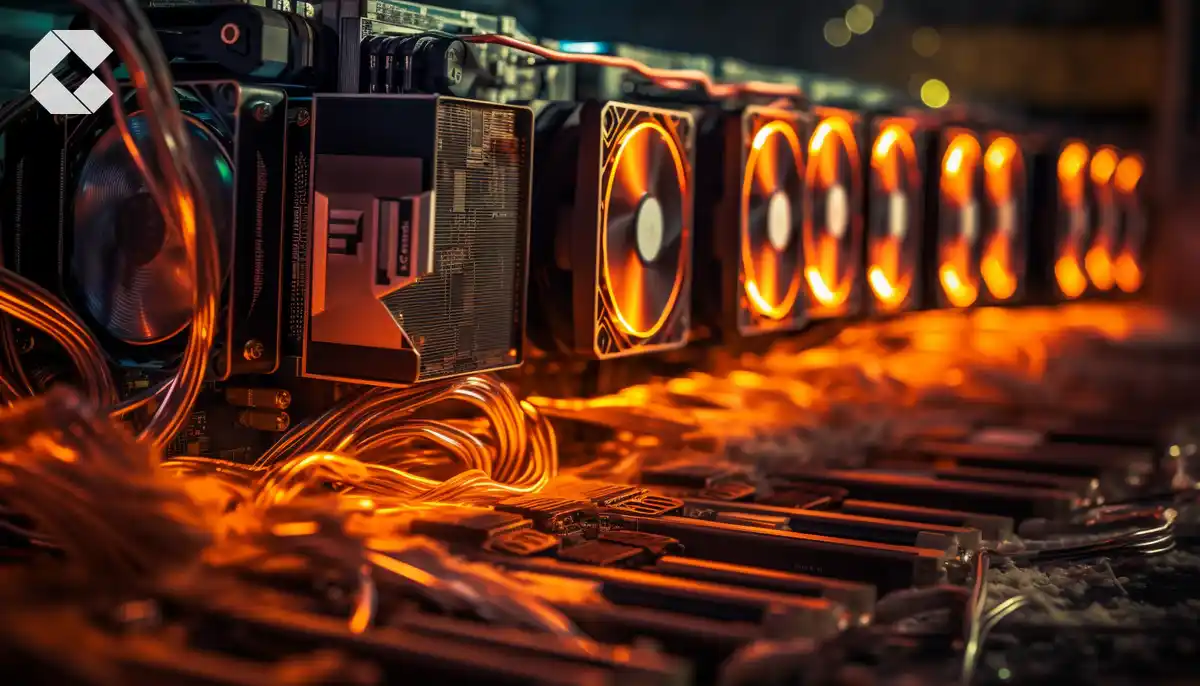

In its annual investor K-10 report, Riot outlined 13 risk factors that could impact its business and financial operations. One of the significant challenges highlighted is the escalating hash rate required to mine a Bitcoin reward. The hash rate is the computing power necessary to solve the cryptographic puzzles underlying every Bitcoin transaction. To cope with this, Bitcoin miners often deploy highly sophisticated Application Specific Integrated Chips (ASICs) to solve the puzzle and earn block rewards.

Global Supply Chain Disruptions

The global supply chain issue prompted by the Covid-19 pandemic has resulted in constrained supply of semiconductors needed to produce highly specialized ASIC machines. Riot Platforms claimed that several mining firms have been forced to pay premium prices to access the few ASICs available in the market. Limited access to essential infrastructures like electricity distribution and construction materials has also influenced the company’s growth.

Riot Platforms Financial Results

Riot Platforms, boasting a massive lineup of 112,944 Bitcoin miners, earned 6,626 in Bitcoin as profit in 2023. The company’s average cost to mine 1 BTC dropped to $7,539 as of 2023, representing a 19.3% increase from the previous year.

Crypto Regulatory Scrutiny And Climate Change Concerns

Riot Platforms has highlighted the escalating scrutiny from government stakeholders regarding the environmental impact of its operations as a significant obstacle. New legislation and increased regulation concerning climate change could impose significant costs on the company and its suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting, and other compliance-related costs.

Stringent regulatory oversights on crypto mining practices are being discussed in the US, with the US Energy Information Administration (EIA) creating a survey targeted at crypto mining firms. Riot Platforms stated that strict regulatory oversight of its business ecosystem could see it lose any form of competitive advantage it has over its peers in other regions.

Ian is a cryptocurrency enthusiast blending humor with professionalism. With an engineering background and a storyteller's heart, he simplifies the blockchain world with sharp analysis and a touch of wit. At Cryptowire, he brings his unique perspective to make digital financial innovation accessible to all.