📰 Table Of Contents

Michael Saylor’s Views on Recent Crypto Developments

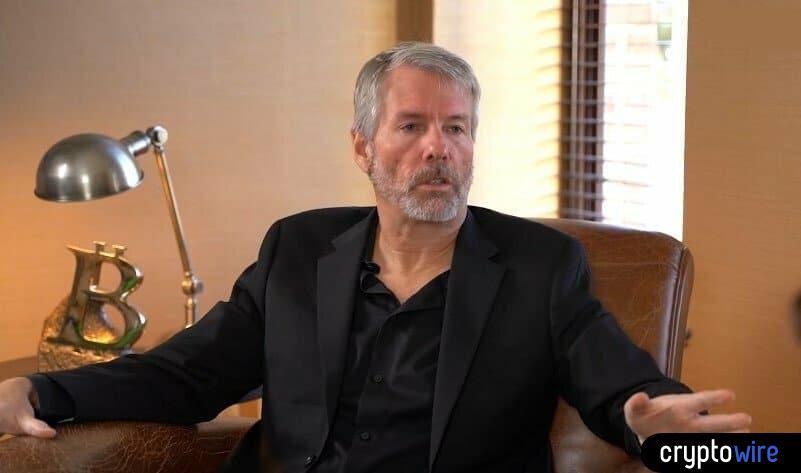

MicroStrategy executive chairman Michael Saylor recently shared his perspective on the approval of Ethereum spot ETFs and its implications for Bitcoin adoption. In a podcast appearance on What Bitcoin Did, Saylor expressed his optimism towards the evolving regulatory landscape in the United States.

Positive Shift in Regulatory Environment

Saylor highlighted the significance of recent developments indicating a more industry-friendly approach by the country’s leadership. He emphasized that these changes are paving the way for broader legitimization of the crypto asset class, with Bitcoin positioned as the leader in this space.

Saylor’s Revised Stance on Ethereum ETFs

Contrasting his earlier statements, Saylor’s current outlook diverges from his previous skepticism towards Ethereum ETF approval. He now anticipates a more inclusive approach towards crypto assets, projecting a positive trajectory for Bitcoin within the institutional investment landscape.

Saylor’s evolving perspective aligns with shifting political winds in May, which have influenced regulatory decisions and public endorsements within the crypto sphere.

Political Factors Driving Change

- Passage of bipartisan legislation enabling US banks to offer crypto custody services

- Approval of FIT21 bill by the House of Representatives, providing a legal framework for crypto operations

- Public support from former President Donald Trump for protecting citizens’ crypto rights

These political developments, coupled with regulatory shifts, have contributed to a more favorable environment for Bitcoin and the broader crypto industry. Saylor believes that increased institutional adoption of Bitcoin may be accelerated as a result of these positive changes.

Ian is a cryptocurrency enthusiast blending humor with professionalism. With an engineering background and a storyteller's heart, he simplifies the blockchain world with sharp analysis and a touch of wit. At Cryptowire, he brings his unique perspective to make digital financial innovation accessible to all.