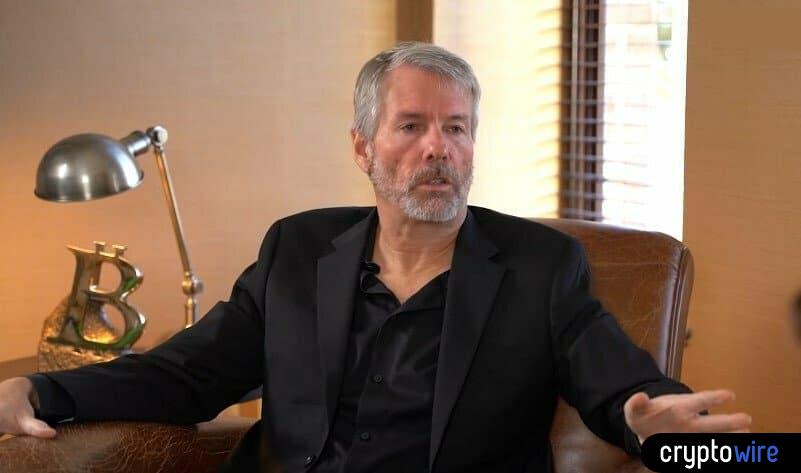

MicroStrategy CEO Michael Saylor, a prominent figure in the cryptocurrency world, has been making waves with his bold statements about Bitcoin. Saylor, whose company now holds a staggering 205,000 Bitcoin, recently shared his belief that people should buy and hold onto their coins for a century. In a recent interview with CNBC, Saylor likened Bitcoin to digital property, describing it as a billion-dollar building in cyberspace that should be held onto for the long term.

Saylor’s commitment to Bitcoin was further demonstrated by MicroStrategy’s recent purchase of an additional $800 million worth of Bitcoin at an average price of $68,377 per coin. This purchase was financed through a $700 million convertible note offering, with a minimal interest rate of 0.625% and repayment due in 2030. With this latest acquisition, MicroStrategy solidified its position as the largest corporate holder of Bitcoin, owning nearly 1% of the total Bitcoin supply.

Saylor’s bullish stance on Bitcoin stems from his belief that Bitcoin is not meant to be sold or spent, but rather held as a store of value. He emphasized that Bitcoin should be viewed as digital property, rather than a digital currency, highlighting its potential as a tool for capital preservation on a global scale.

The executive pointed out that Bitcoin’s market potential as a store of value is immense, with a total addressable market of $100 trillion, far surpassing the market for a medium of exchange. Despite Bitcoin’s current market cap of under $1.5 trillion, Saylor sees significant room for growth, especially when compared to assets like silver and gold.

Saylor also addressed the criticism surrounding Bitcoin’s use cases, particularly its perceived role in money laundering. He argued that Bitcoin’s primary function as property is less controversial and more acceptable to regulators than its use as a medium of exchange. Saylor dismissed the idea of using Bitcoin for everyday transactions, stating that its true value lies in its properties as a long-term investment and store of wealth.

In conclusion, Saylor expressed his belief that Bitcoin will surpass gold as a preferred store of value, citing its superior monetary properties and potential for long-term growth. He highlighted the competition between Bitcoin and traditional risk assets, as well as real estate investments, positioning Bitcoin as a viable alternative for individuals seeking financial security in the future.

Ian is a cryptocurrency enthusiast blending humor with professionalism. With an engineering background and a storyteller's heart, he simplifies the blockchain world with sharp analysis and a touch of wit. At Cryptowire, he brings his unique perspective to make digital financial innovation accessible to all.